Midlife crises and financial (in)security

How to tackle the biggest barrier to your freedom

Burnt Out? Stuck? You're Not Broken

–

Find Your Discernment

–

Click Here To Work With Me

–

Burnt Out? Stuck? You're Not Broken – Find Your Discernment – Click Here To Work With Me –

In the last few years, as I’ve talked to countless clients and, more importantly, potential clients about navigating burnout, stuckness, or a midlife shift, the single most common thing I hear about why they stay stuck is, “I can’t afford to change.”

So, today, let’s talk about exactly how to deal with that. Financial insecurity is a huge, and very valid, fear (especially these days)—but it may not be as big an issue as you think.

Here’s how to figure it out.

The why: Your non-negotiables

Before we get to calculating your financial runway, we’ve got to address a deeper, philosophical question: What are your non-negotiables?

Nobody chooses to have a midlife crisis. Nobody chooses to get stuck. Instead, we make a whole bunch of reasonable micro-decisions that end up getting us stuck (more on the reasonableness trap in that link).

Continuing to make those sorts of micro-decisions and hoping you get unstuck is, obviously, definitionally insane. So start with figuring out the non-negotiables for the next chapter of your life.

When I advise medical residents who are looking for their first attending-level job, my counsel is the same: pick three things that are non-negotiable for you, and then be willing to negotiate the rest. Salary, I often find myself having to remind them, does not have to be one of those three.

When I was starting out my clinical career, my top three were

The freedom to spend 6 weeks a year working in global health

The ability to practice my subspecialty of head and neck cancer, instead of doing general ENT

Staying in the same city as my then-partner

Because these were my non-negotiables, salary would, necessarily, have to be something I’d willing to budge on.

Turns out, a whole lot more jobs than I expected were willing to entertain a non-traditional structure that included 6 weeks in global health, in exchange for an equally non-traditional funding set-up.

So…first things first. What are your three non-negotiables?

And is financial security one of them?

The how: Time to run the numbers

Things have changed since I was an idealistic resident. These days, financial security very much is in my top three, and I suspect it’s in yours too (you wouldn’t be reading this otherwise, after all).

Then it’s time to run the actual numbers. Let’s figure out your financial runway. Objectively.

Not by vibes.

It’s super common for my clients to feel like getting unstuck would necessarily lead to financial insecurity. We do what we know, and we fear the uncertainty of what we don’t, so that makes all the sense in the world.

It’s also very common for my clients to find out that, actually, they have a bit more freedom than they thought they did. Here’s how they get to that conclusion, and how you can too:

Step 1: What could you draw from? Let’s take a hypothetical client named Sam, who has found themselves in that near-inevitable midlife crisis. They’ve worked in IT their entire careers, and they’ve gotten to the point where nothing is inspiring. They’re bored, a tad burnt out, and feeling stuck.

They want to try something new—but maybe not a new sports car or side piece.

Instead, Sam has always wanted to open a bookstore-wine shop-cafe. They’ve never taken the leap, though, because that feels risky and fiscally prodigal.

They’ve done okay for themselves in IT so far — they’re by no means in the 1%, but they do have a bit of a nest egg. They also have two kids whom they need to send to college.

So the first thing I’d tell Sam to do is figure out all their savings, anywhere. Do they have a 401K? Do they have an emergency fund? A savings account? A college fund? Treasury bonds that their great aunt Gertrude bought for them when they were twelve?

Whatever those are, they are the sum total of Sam’s available cushion.

Step 2: What do you want to draw from? Sam, being a fiscally responsible parent, doesn’t want to jeopardize their kids’ education in the slightest. They also quite like having an emergency fund at the ready.

This means, their actual, operable cushion consists of three accounts: their savings, their 401K, and great aunt Gertrude’s treasury bond.

Let’s put some actual numbers to this. By the time most Americans hit midlife, the data shows they have between $168,000 and $313,000 in savings. To make the math easier let’s put Sam on the low end of that and say that they have $180,600 in their three operable cushion accounts.

(They have more in their emergency account and their kids’ college funds, but remember, we’re not touching those.)

So, even though they could draw down from more, their financial cushion is $180,600.

Step 3: How much are you drawing down each month? The next question I ask my clients is how much, on average, are they spending per month?

If you use any sort of budgeting software, that’s often an easy number to find. If not, this one takes a little bit of doing. But I’d encourage you to do it. Go through your bank statements for the last 12 months. Write down how much you spent each month and then take the mean (that is, add all 12 of those numbers together, then divide by 12).

Since the average family of four in the US spends about $8600 per month, we’ll assume that’s Sam’s monthly spend as well.

Step 4: How long is your runway? This is where the magic happens.

Divide the number from step 2 by the number from step 3. That’s how many months you could survive with zero income.

In Sam’s case, $180,600 in cushion, divided by $8600 / month, is 21 months.

That is a substantial cushion! In other words,

If Sam quit their job today, and had no other income coming in, they could go about 21 months before they had to dip into their emergency fund.

Think about that.

What would YOU do if you knew that you had almost two years at your disposal, two years to build the life you deeply wanted?

What sorts of risks would you take? What things would you try? What doors would you open?

Make the runway work for you

Last couple of tweaks to the runway.

Step 5: When do you open your parachute? While it’s true that Sam could go a full 21 months before they dipped into their emergency fund, they might want to pull the rip cord earlier!

If everything went pear-shaped, and Sam’s coffee-wine-book shop turned zero profit, then waiting until month 22 to start looking for a new job would mean they’re absolutely, definitely dipping into their emergency funds.

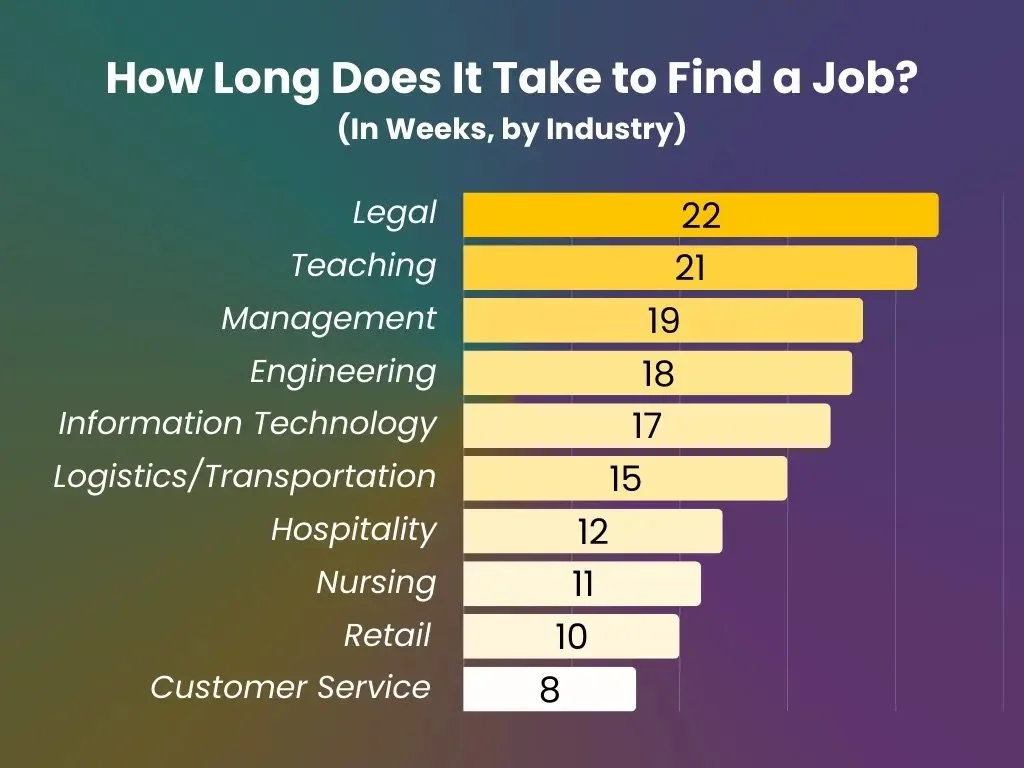

So instead, Sam looks up how long it takes to find a job in their industry (here’s one source), because if all else fails, they’d have to return to it.

My advice to my clients—and to Sam—is to take the average time to find a job in their industry, multiply that by 1.5, and make that their rip cord day.

In other words, since Sam is in IT, where it takes an average of 17 weeks to find a new job, they would multiply 17 by 1.5, which is 26 weeks.

Sam’s initial runway was 21 months (or, just about 91 weeks). 91 weeks minus 26 weeks is 65 weeks.

This means that if Sam has made it to 65 weeks, and their coffee shop is still making them zero dollars, that’s when they start shopping their IT resume around.

Step 6: Shades of grey. So far, every single step here has assumed that Sam quits their job altogether, and that they make absolutely nothing from their coffee shop! The 21-month runway is all expense, no income.

Sam could extend their runway in any number of ways:

They could switch to part-time at work while they’re opening their coffee shop.

They could pick up side hustles that bring in some income. Even $1000 a month of income would add an extra three and a half months to their runway!

They could, obviously, tighten their spending. (For various reasons, by the way, I don’t actually recommend this one as often)

And so on…

Final thoughts

Financial security is hugely important. And the fear of financial insecurity is the single most common reason, in my experience, that people stay stuck in their midlife crises.

But it doesn’t have to be this way. There is a way to defang the fear of financial security. It might take a tiny bit of math but…

What would you do if you knew you couldn’t fail?

This exercise may just give you that gift—a stretch of time where, even if you did fail, you’d be able to pull the rip cord early enough that you could land safely.

This exercise may just give you that gift. Now it’s up to you to decide: what are you going to do with that gift?

It’s yours for the taking.

Want to work through these sorts of questions for your specific situation? Are you stuck and not sure how to move forward? You aren’t alone. Let’s talk about getting you to a life you’re not trying to quit every day.

→ Check out my courses here. They range from 4 weeks to a year, and they take you from “what the heck do I do next” all the way to clarity and a step-by-step plan that honors both your calling and your right to thrive. Click here to apply!

→ Want more FREE weekly content about making consequential life choices with confidence and clarity? Join my mailing list!